The board chairman of a Canadian asset management company named Sprott Asset Management, John Ciampaglia, believes nuclear power will have a prosperous future. Investors who can ride along on the price of uranium, the raw ingredient for nuclear power plants, have a massive opportunity in front of them.

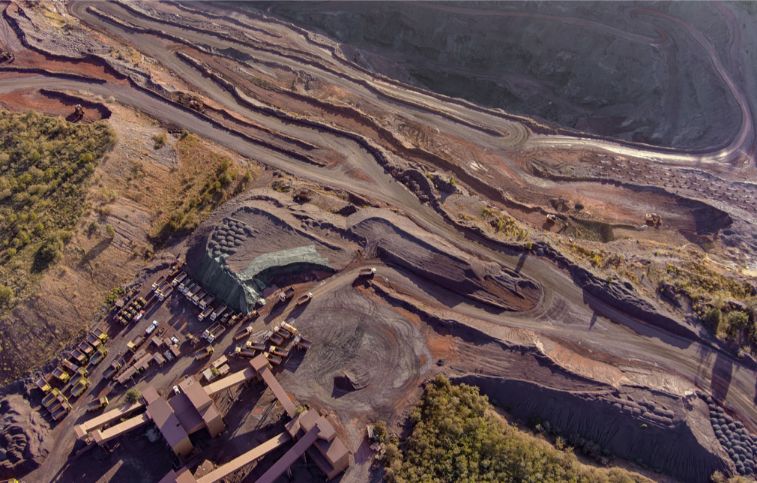

Ciampaglia put his money where his mouth is and began collecting immediately after making his statement. His Sprott Physical Uranium Trust already has a stockpile of nearly 27,000 tons of uranium, roughly equivalent to one-third of the yearly consumption worldwide. Moreover, that mountain is expanding in value.

For the first time since the beginning of the spring, the price of a pound of uranium (rounded to 454 grams) in a form that is often traded was greater than $50 this week. Although not quite as high as they were immediately following the Russian invasion of Ukraine, when prices for all commodities shot through the roof, they are nevertheless historically very high. In fact, the cost of uranium has been rather low for many years. After the nuclear tragedy at Fukushima in Japan in 2011, public perception of nuclear power took a nosedive. Existing nuclear power facilities were shut down, while construction of new nuclear power plants was placed on hold. Uranium’s price plummeted along with the precipitous drop in demand for the element.

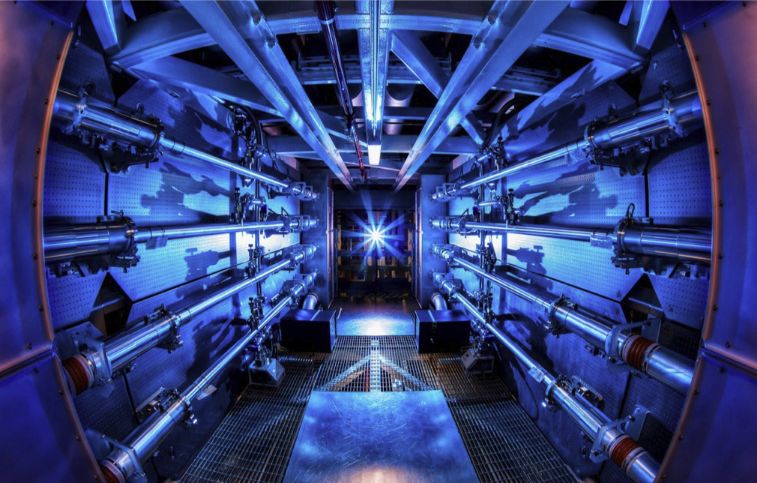

Ciampaglia, in agreement with other advocates of this strongly contested method of producing electricity, contends that the shift to clean energy is impossible without nuclear power. He claims that wind turbines and solar panels are insufficient to supplant fossil fuel use entirely, and he also believes that it is challenging to store renewable energy. It is not an option to turn off the lights when there is no wind blowing or when the sun is not shining because this inevitably leads to the use of nuclear energy. And to uranium.

The tide is turning in favor of those who advocate for using nuclear power. The European Union has not too long ago designated nuclear electricity as “green,” in the same vein as natural gas, for that matter. The so-called taxonomy is a label that is part of the European categorization system. Its purpose is to act as a reference for investors. The climate program proposed by Vice President Joe Biden of the United States includes nuclear power as an integral component.

In addition to that, there are also concerns regarding the supply. An uproar was caused by the fact that a shipment of Russian uranium was going to be used in nuclear reactors in Europe just the week before. Russia is not the only significant producer of uranium, but it is one of the major producers. Uranium is not included in the scope of the sanctions, but filling Putin’s war chest with money from state-owned Rosatom is met with criticism. In addition, Putin can decide to cut off the supply, just like he did with Russian gas.

As the price of uranium rose, so did the share prices of publicly traded mining firms and a wide variety of investment products that derive their value from uranium, such as Sprott’s fund. Nevertheless, if you look at those price charts carefully, you will notice that they display a pattern that looks much like swabbing. It would appear that investors do not have complete confidence in themselves.

Wim Turkenburg is another person who is suspicious about the uranium hype. According to the energy expert, there is no urgent justification for price increases. “The number of nuclear power facilities across the globe has remained roughly the same up to this point. In order to maintain some semblance of equilibrium, existing ones are being shut down while new ones are being commissioned. Therefore, there will not appear to be a sharp increase in the need for uranium.”

Additionally, Turkenburg emphasizes that constructing new nuclear power facilities is time-consuming, particularly in Western Europe nations. “Because there have been so few new power plants constructed in the last few decades, our company no longer possesses the necessary knowledge and skills. In addition, you can observe that the costs of the power plants that are currently being constructed always end up being significantly more than anticipated, and the duration of the construction process is also significantly longer.”

Turkenburg predicts that constructing a brand-new nuclear power station in Europe could begin around 2040. To put it another way, around twenty years from now. According to him, a nuclear power plant with a high price tag and a lengthy delivery schedule does not necessarily suggest a poor investment. What is important is the duration of the period. “The average lifespan of a nuclear power facility is sixty years. After that amount of time, it will have paid for itself. On the other hand, this is an extremely long time horizon for a business enterprise. Without financial assistance from the government, it is impossible to construct a nuclear power plant.”

Although Turkenburg does not give the impression of being an ardent supporter or opponent of nuclear power, he believes that it should continue to be an option and that research ought to be carried on to develop safer and more efficient plants. In the long run, this could result in a future with an increase in the demand for uranium and the use of nuclear power.

In the meantime, investors in uranium face a significant amount of risk in the here and now. The rapid elimination of the need for nuclear power might be brought about by a breakthrough in the field of renewable energy; this is not to mention the arbitrary nature of the politicians who will have to make critical decisions on the energy transition. In addition, as is frequently the case with commodities, higher prices might, in turn, cause more production, which subsequently drives down the price. This phenomenon is common.

Then there are the issues around nuclear safety as well as nuclear waste. The nuclear power industry would almost completely fade into the background with just one occurrence. That does not even have to be a natural disaster or a malfunction in some piece of technology. According to the International Atomic Energy Agency, the fact that Russia is now occupying the Zaporizhzhya nuclear power facility in Ukraine creates an unsafe situation (IAEA). This Thursday, the nuclear watchdog organization urged Russia to withdraw from the reactor.