On Thursday, the materials expert agreed to a deal with PowerCo, the battery business of the Volkswagen Group. The two companies are “looking at a long-term plan to work together” to supply a battery facility that Volkswagen plans to build in North America.

Investors responded well. After the preliminary deal was reached with PowerCo, Umicore’s share price increased by 1.7%, reversing a daily loss of almost 1%.

Umicore makes cathode material, a pure mixture of lithium and an alloy of nickel, cobalt, and manganese, used to make battery cells for electric vehicle battery packs.

The cathode price determines approximately 50% of the price of a car battery. In contrast, the battery typically accounts for 40% of the entire production cost of an electric vehicle. As a result, thousands of dollars will be spent on electric Volkswagens containing Umicore components.

On Thursday, PowerCo signed a contract with the Canadian government to look for a site for a battery factory. By 2030, PowerCo might start purchasing battery materials from Umicore for 550,000 electric cars per year. The size of this market has yet to be discovered. Volkswagen will likely become Umicore’s main customer at its North American facility.

The initial destination for PowerCo’s batteries is the Volkswagen facility in Chattanooga, Tennessee, where the German automaker now manufactures the Passat and the Atlas SUV. Volkswagen previously announced that it would invest $690 million in an electric vehicle assembly line in Chattanooga.

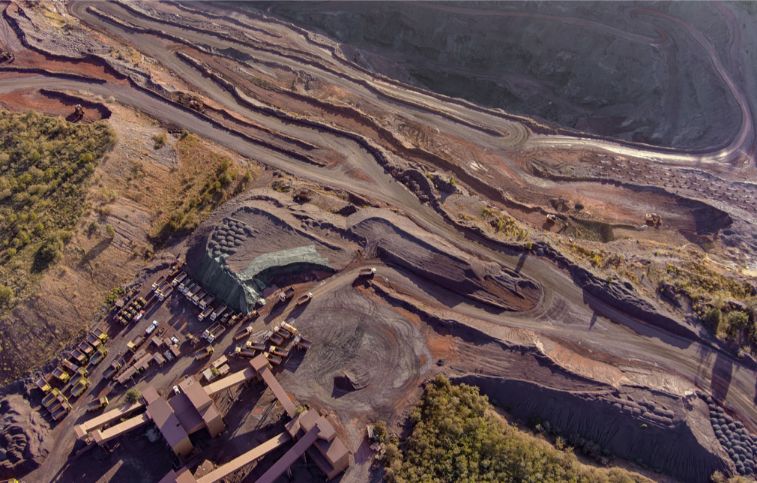

Earlier this year, Umicore decided to develop a battery materials plant in the Canadian province of Ontario, putting aside almost $1 billion for the project. The exact location will depend on where PowerCo wants to build its battery factory.

This billion is only the beginning for the Canadian factory. Umicore still needs to determine the size of the battery materials factory. That relies on the number of clients the business can get.

Volkswagen and Umicore are familiar with one another. In September, PowerCo and Umicore launched a joint venture. For 3 billion dollars, this unnamed car will construct battery plants across Europe. In the meantime, Umicore has opened a battery materials production plant in Nysa, Poland.

Umicore provides the primary materials, while PowerCo manufactures the battery cells. This should result in a total battery production capacity of 160 gigawatt-hours by 2030, sufficient for about 2,2 million electric vehicles per year.

Initially, the North American factory will likely be smaller. The United States’ fleet electrification is significantly lagging behind Europe and China. Umicore chose Ontario because it is next to the mines that provide the raw ingredients for battery materials and next to Michigan, the center of the North American automobile industry.

Umicore CEO Mathias Miedreich started a $5 billion investment program this year. The Canadian factory is one of the essential parts of the program. By the end of this decade, Umicore will have battery materials manufacturing facilities in three of the world’s most important automotive areas: East Asia, Europe, and North America.

PowerCo is Umicore’s only customer in North America, so more is needed to help the company reach its goals. CEO Miedreich has already agreed to work with ACC, a Mercedes-Benz and Stellantis joint venture, to make vehicle batteries together in Europe. Two giga plants, supplied by Umicore, will produce batteries with an annual capacity of 120-gigawatt hours. Stellantis, Mercedes-Benz, and the Volkswagen group account for fifty percent of Europe’s automobile sales.

The European agreement with ACC could be replicated in North America. Mercedes has a plant in Tuscaloosa, Alabama, where over 300,000 big SUVs are made yearly. Stellantis’ choice of Umicore may be even more apparent: the company has a Chrysler plant in Ontario and makes Jeeps near the U.S. border in Detroit.