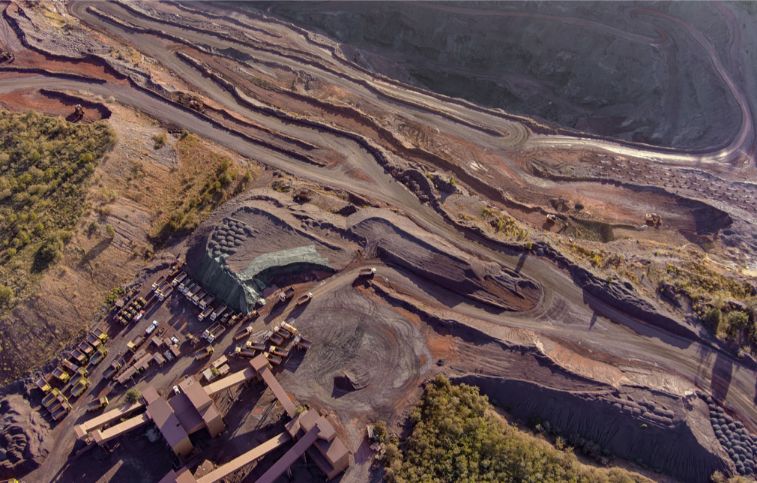

As a result of the commodities market’s role in causing one of the most precarious circumstances for the macroeconomy in recent years—namely, rising inflation—the commodities market has emerged as one of the year’s most important players.

It should be no surprise that the surge in demand that followed the release of Covid caused bottlenecks, which in turn drove up the pricing of essential supplies. In addition, the conflict in Ukraine and the oil crisis have contributed to the overall deterioration of the inflationary environment.

After months of dealing with this predicament, some voices have begun to emerge, predicting that the worst of it has passed. The highest point of inflation has already been reached, and even though there will still be months in which rates are expected to be higher than the average of the preceding few years, consumer prices will progressively fall. This argument is supported by a reaction that has already been occurring for months in the market for basic resources: the prices of the commodities that are traded the most appear to have reached their peak for the year in June, and since then, the correction has been generalized to almost all of the commodities that are listed.

Palladium, live cattle, rice, and soybeans for animal feed are the only four items on the list of the top 34 most traded commodities that have not been adjusted since June 7; their prices have increased by 19.3%, 7.9%, 4.7%, and 3.8%, respectively. That day marked the beginning of a downward trend for the Bloomberg basket of commodities, a correction that would eventually take 14% of the selective.

Except for tin, which has experienced a decline on the London Metal Exchange (LME) of 41.5% since June 7 and is the commodity that has experienced the most significant decline since that date, oil and its derivatives are the commodities that have experienced the most significant declines during this period. Since then, the price of a barrel of European Brent crude has dropped by 23%, while the price of a barrel of West Texas crude has dropped by 27%.

Cotton, copper, and wheat have all had declines of about 20% throughout this period, while other industrial metals, such as aluminum and nickel, have experienced declines of nearly 18%.

Some researchers believe inflation may have already reached its maximum level due to the continued fall. According to Pramod Atluri, a manager at Capital Group, there are “many signs” that inflation has reached its peak. As evidence, he cites the decline in the price of gasoline since the middle of June and the decline in the price of wheat, corn, and other commodities since the middle of May. He states, “Perhaps the Fed has the hedging it needs to boost economic growth while treating inflation seriously.”

More specifically, it is the Federal Reserve and other important central banks worldwide, such as the European Central Bank (ECB). Because of these policies, many business managers and analysts are beginning to worry about the upcoming economic downturn. The most recent survey of managers at Bank of America during the first week of September provides further evidence that most managers saw a worldwide recession as the most likely scenario for the coming months.

Many investors are selling commodities on the market out of anticipation of additional price falls in the coming months because they are afraid there would be a drop in demand if this eventually comes to fruition.

This decline in the price of commodities since June is primarily attributable to the expectation of future demand. Oil is the best example; even though the Organization of Petroleum Exporting Countries (OPEC) and its external partners have decided to change the direction of their policy and begin to reduce supply to boost prices, their efforts have not been sufficient to counteract the falls that are occurring in the energy resource so far.

The most recent oil market report from the International Energy Agency (IEA) makes it abundantly clear: the organization has reduced the pace of oil demand growth for this year due to a slowdown in consumption, and it already forecasts that 2022 will be the first year in which China’s demand for oil is going to fall. This did not occur during either the Covid crisis, which occurred in 2020 or the Great Financial Crisis, which occurred in 2008; however, it is expected to occur in 2022. If the predictions of the IEA come true, it will be the first time that it has occurred in over three decades, in the year 1990.