Suppose your smartphone suddenly stops functioning, and if, at the same moment, your laptop and television fail, the power goes out. Your car won’t start, and you face a highly inconvenient, if not frightening, situation. This cluster of mishaps shouldn’t occur in theory.

This wouldn’t happen unless a certain subset of this apparatus were missing. What are the key components? The periodic table’s 17 rare earth elements (REEs) are all metals. In other cases, rare earth elements (REEs) may make up only a marginal percentage of the final product.

However, many electrical, optical, magnetic, and catalytic applications require them because of their high melting and boiling temperatures, and they cannot be substituted for these purposes without using compounds. Indeed, “technology metals” is what many investors refer to as REEs.

- What Are Rare Earth Elements (REEs)?

- Uses of Rare Earth Elements

- How does the Rare Earth Elements industry look like?

- How are Rare Earth Elements Mined and Extracted?

- Rare Earth Elements Supply and demand

- How to Invest in Rare Earth Elements?

- Stock Exchanges and Brokers that list Rare Earth Elements Stocks

- What are the Best Rare Earth Element Mining Stocks?

- Investing in Rare Earth Elements Comes with Risks

- The Final Thoughts

What Are Rare Earth Elements (REEs)?

The seventeen chemical elements known as rare earths form a block. Yttrium and the other 15 lanthanide elements make up this family. Scandium is often categorized as a rare earth element due to its prevalence in rare earth element mines. Scandium is considered a rare earth element by the International Union of Pure and Applied Chemistry.

Because of their metallic nature, rare earth elements are collectively known as rare earth metals. Several of these metals are discovered together in geologic deposits because they share many of the same characteristics. Since many of them are commonly sold as oxide compounds, they are also known as “rare earth oxides.”

Uses of Rare Earth Elements

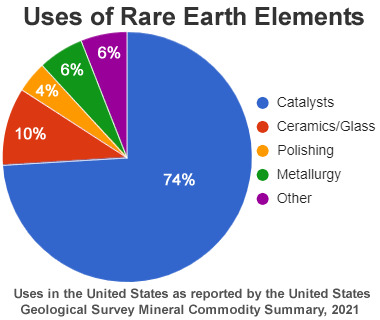

Rare earth elements (REEs) have many uses in industry, including electronics, renewable energy, transportation, aircraft, and defense. The production of permanent magnets is the most important use for REEs, accounting for 29% of projected demand in 2020.

Electronic devices such as mobile phones, televisions, laptops, vehicles, wind generators, and jet planes couldn’t function without using permanent magnets. Because of their luminous and catalytic qualities, REEs are also commonly used in high technology and “green” products.

“Many forms of ray tubes and flat panel displays utilize phosphors, substances that emit light, and certain rare earth elements (REEs) are used alone or in combination to generate these phosphors. Some rare earth elements are employed in more modern forms of lighting, like fluorescent and LED bulbs.

For the anodes, nickel-metal hydride batteries use lanthanum-based alloys. Some batteries require 10–15 kilos of lanthanum per vehicle when employed in hybrid electric vehicles.”

How does the Rare Earth Elements industry look like?

In 2021, the global rare earth elements market was worth $8.3 billion. By 2027, the IMARC Group forecasts, the market will be worth US$18.4 billion, representing a compound annual growth rate (CAGR) of 15.2% from 2022 to 2027. With COVID-19’s ambiguity in mind, we constantly monitor and assess the pandemic’s direct and indirect effects. The study acknowledges the significance of these findings to the industry. In the past 15 years, China has become the world’s primary producer of rare earth materials and finished goods. Because of this pattern, worries about a long-term supply crisis have emerged.

While REO prices reached an all-time high in the middle of 2011, they have since fallen as demand has decreased. The 2011 price increase can be traced back to supply worries. Consumers hoarded REEs in anticipation of higher prices when Chinese authorities imposed export duties and limits on the materials.

How are Rare Earth Elements Mined and Extracted?

Chemical methods of REE extraction and separation cannot be used until the REE-bearing rock has been dug up and the REE content is concentrated. Most rare-earth ores are extracted using standard open-pit mining techniques, which entail breaking rock apart using explosives before loading it into trucks with giant shovels and transporting it to a concentration plant.

The REE-bearing minerals in a rock are concentrated by being physically isolated from all other rock minerals. To separate the rare-earth minerals from the other minerals in the ore, they must be crushed and ground several times.

The next step, froth flotation, involves coating the rare-earth minerals with a chemical that repels water, causing them to float to the surface of agitated tanks linked to air bubbles. The concentrate is then taken off.

The leftover minerals are transferred to the landfill, while the rare earth element (REE) concentrate undergoes further local or offsite processing. Efforts are being made to find cost-effective ways to handle low-grade REE ores by modifying the flotation process and using other reagents.

The Leading Rare Earth Elements Producers in the World

There was a notable increase in rare earth metal production in 2021, with global output reaching 280,000 metric tons (MT), up from 2018’s figure of 190,000 MT.

Nearly 168,000 metric tons of rare-earth oxide were extracted from Chinese mines in 2021. Producing rare earths, China dominates the global market. With about a fifth of China’s output, the United States remains far behind as the world’s second-largest producer of rare earths.

In 2021, China’s rare earth mines produced over 61% of global production, making the country the dominant producer. A staggering 83% of global production came from China in 2016. In 2021, the United States only contributed 15.5% of the world’s rare earths production. Next to China and the United States in output that year were Myanmar and Australia, each producing around 26,000 and 22,000 metric tons.

Rare Earth Elements Supply and demand

Supply

In 2020, Chinese rare earth producers will account for almost 80% of global production. Since 2015, external supply from Malaysia, the United States, Russia, Vietnam, and India has increased, resulting in decreasing reliance on China’s domestic supply.

Total rare earth oxide (TREO) output in China was 135,000 tons in 2020, equivalent to 26,000 tons of NdPr oxide out of a total global supply of 46,000 tons. In 2030, the world’s supply of NdPr oxide will need to increase by 52,000 metric tons to fulfill demand projections.

The Chinese government’s policies and environmental regulations will continue to limit the country’s ability to produce its goods in the foreseeable future. To meet the ambitious goals of Made in China 2025 and the anticipated high demand for NdPr oxide, China will “under clear policy” look for suppliers outside of the country.

Australia and North America plan to create more supply to fulfill future demands over the next decade, and China will have less of a hand in the global supply market by 2030.

Demand

Demand for rare elements is likely to continue high in the future because of the clean energy economy, which is being fueled by e-mobility and wind power. In 2020, the world consumed 167,000 TREO of rare earths, expected to rise to 280,000 TREO by 2030. Strong growth for NdPr oxide in Neodymium Iron Boron (NdFeB) magnets used in EV traction motors indicates China’s continued market dominance, bolstered supply chain, and increased use of rare earth elements in e-mobility.

NdFeB magnets are the single greatest use for rare earth elements, accounting for 30% of the market. The fastest-growing NdPr oxide markets include NdFeB magnets for use in automobiles, wind turbines, and automated production lines.

Since 2005, NdFeB magnets have seen significant demand due to their widespread implementation in electric drivetrains and electric power steering in battery, plug-in hybrid, and hybrid electric vehicles. The number of passenger EVs has increased from 450,000 in 2015 to over 3.2 million in 2020, and the number is expected to increase to 34 million worldwide by 2030.

How to Invest in Rare Earth Elements?

In the rare-earth-elements market, there is a wide range of possible investments. The most direct route is investing in a firm whose business is extracting or transforming these materials. China may be the primary producer of rare earth elements, but other countries are increasing output to meet rising demand. Therefore, these mining businesses should be able to offer reliable returns to their shareholders over the long term.

Mutual funds and exchange-traded funds that carry a diversified portfolio of stocks involved in rare earth element development are other options for investors. VanEck Vectors Rare Earth/Strategic Metals ETF (REMX) is the most easily accessible of them.

It has stakes in some of the most important rare earth producers and processors in China, the United States, and Australia. Alternatively, the Swiss mutual fund Dolefin Rare Earth Elements Fund invests in rare earth and platinum group manufacturers.

Finally, investors can think about going full circle by purchasing shares from firms specializing in rare earth element recycling. Metal Tech Recycling Corp (NASDAQ: MTRX), American Resources Corp (NASDAQ: AREC), and Geomega Resources (GOMRF) are all examples of such firms operating in the United States and Canada, respectively.

By purchasing shares in these businesses, investors can obtain access to the rare earth marketplace and protect themselves from supply interruptions if they occur.

Stock Exchanges and Brokers that list Rare Earth Elements Stocks

You can buy shares of companies producing rare earth elements on the following stock exchanges and brokerages:

- The New York Stock Exchange (NYSE)

The stocks of several Rare Earth Element companies, including MP Materials (MP), Lynas Corporation (LYSCF), and Great Western Minerals Group (GWMGF), are traded on this international market.

- The NASDAQ Stock Exchange

This American stock exchange is home to many publicly traded companies, including Rare Element Resources (REE) and Ucore Rare Metals (UURAF).

- The London Stock Exchange (LSE)

Among the British stocks traded, there are shares of Baotou Steel Rare Earth (601111. SS) and China Rare Earth Holdings (CREHF).

- The Toronto Stock Exchange (TSX)

Several Rare Earth Element firms are traded on the Canadian stock exchange, including Great Western Minerals Group (GWG), Quest Rare Minerals (QRM), and Avalon Advanced Materials Inc (AVL).

- The Frankfurt Stock Exchange

Many Rare Earth Element stocks, like those of Baotou Steel Rare Earth (601111. SS) and China Rare Earth Holdings (CRH), are traded on Germany’s Frankfurt Stock Exchange (CREHF).

- The Australian Securities Exchange (ASX)

The Australian stock exchange is home to some Rare Earth Element companies, including Lynas Corporation (LYC), Northern Minerals (NTU), and Arafura Resources (ARU), to name a few.

- The Hong Kong Stock Exchange

The Hong Kong Stock Exchange is home to several Rare Earth Element firms. These include China Rare Earth Holdings (CREHF) and China Northern Rare Earth Group High-Tech Co., Ltd. (0969. HK).

What are the Best Rare Earth Element Mining Stocks?

The top stocks for investing in rare earth elements are listed below.

MP Materials (NYSE: MP)

Current Price: $30.07

Market Cap: $5.342B

The next company on our list is MP Materials, the largest rare earth materials manufacturer in the Western Hemisphere. Its production met about 15% of the world’s rare earth requirements in 2021.

MP Materials reported excellent Q2 financial results on August 4th, largely due to increasing demand and pricing for rare earth elements utilized in electric vehicles and other consumer items.

At $143.6 million, sales are up 96% year-over-year. Compared to the same period a year ago, adjusted earnings increased 139%, coming in at $81.9 million, or 43 cents per diluted share. The company’s free cash flow was $102.4 million, an increase from the free cash flow of $3.3 million a year earlier.

The rare earth miner sends more than 90% of its processed goods to China. But it is improving two processing plants in the United States. As a result, it should be able to offer isolated, rare earth oxides directly to end customers and transform particular rare earth elements into metal sheets and magnets. Investors will be watching to see the bottom-line impact of reduced China dependence.

Lynas Rare Earths (ASX: LYC)

Current Price: $6.30

Market Cap: $5.697B

The Australian mining business Lynas Corporation is the largest non-Chinese producer of rare earth elements. The company runs a processing plant in Malaysia and a mine in Western Australia with one of the world’s highest-grade rare earth resources.

In terms of annual output, Lynas’s production of about 20,000 metric tons of rare earth oxides makes it the world’s largest producer of rare earth oxides outside of China. Neodymium-Praseodymium (NdPr) is the company’s major offering, and it’s utilized to make permanent magnets for things like electric automobiles and wind turbines.

Since rare earth elements are predicted to be in more demand, Lynas Rare Earths could be an excellent investment. According to research by the US Department of Energy, the demand for rare earth elements is expected to expand by 4-5% yearly, driven by the expansion in the electric car and sustainable energy markets and military and defense purposes.

MP Materials (NYSE: MP)

Current Price: $30.12

Market Cap: $5.348B

MP Materials extracts and refines these metals as an integrated rare earth mining and processing facility owner. Compared to the Zacks Mining – Miscellaneous industry’s anticipated earnings growth of 28.9% for the current year, the company’s estimated earnings growth rate is 88.9%.

Over the past 60 days, analysts have increased their projections for the company’s current-year profits by a factor of 59.4%, according to the Zacks Consensus Estimate. Zacks has assigned MP Materials a #3 Rank.

China Minmetals Corporation Ltd. (000831.SZ)

Current Price: CNY 38.51

Market Cap: $37.774B

Regarding metals and minerals, China Minmetals Corporation is a powerhouse. Their website proudly proclaims that they will be a state-owned enterprise worth approximately $54 billion by 2020. The corporation does many different things, like explore metals and minerals, mine for them, refine them, and trade them.

Rare earth elements, which have numerous technological applications, are produced by China Minmetals, adding another dimension to the company’s business model. More than 85 percent of the world’s rare earth elements are mined in China, making it the leading producer. Regarding rare earth elements, China Minmetals is a prominent player.

Investing in Rare Earth Elements Comes with Risks

Despite the hype surrounding the importance of some rare earth metals (particularly neodymium and praseodymium), the world doesn’t want a lot, as Lynas’s demise should serve as a cautionary tale for anyone considering investing in rare earth stock.

Today, the annual global output of rare earth oxide is around 150,000 metric tons, or approximately half the capacity of a bulk carrier that visits Australian coal and iron ore ports.

Mining giants like BHP (ASX: BHP) and Rio Tinto (ASX: RIO) aren’t interested in rare earth elements because their year’s worth of material consumed is just about US$5 billion.

All the while, China has the authority to control prices; the consequences become more apparent when you consider that rich deposits of rare earth elements are tough to locate, often possess environmentally demanding elements like uranium, are diabolically hard to analyze, and require a specialist marketing strategy.

The Final Thoughts

There are 17 rare earth elements (REEs) that have numerous industrial applications in fields as diverse as electronics, clean energy, aerospace, automotive, and defense. The greatest and most important end application for REEs in 2020 is expected to be permanent magnets, a key component of modern electronics.

The value of the global rare earth elements market was $8.3 billion in 2021, and it is projected to increase to $18.4 billion by 2027, expanding at a CAGR of 15.2 percent between 2022 and 2027. China has become the world’s largest producer of rare earth minerals and their processed derivatives, leading some to worry about a structural supply crisis in the market.