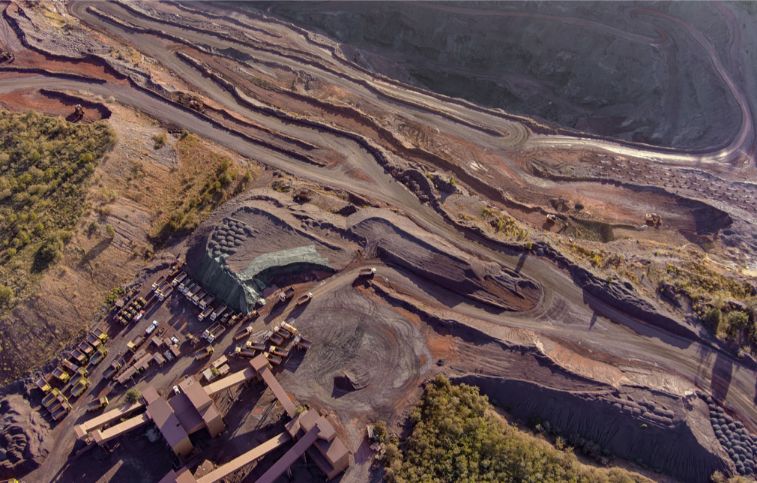

Arizona Silver Exploration. (TSXV: AZS) recently revealed that it has finalized its non-brokered private placement, issuing 4,491,260 units at the price of C$0.25 each. This placement yielded a total of C$1,122,815. Each unit consists of one common share of the Company and half of a transferable common share purchase warrant. The warrant holders shall be entitled to purchase one additional share within five years from the date of closure at an exercise price per warrant share of C$0.40, provided that the closing price of the Company’s common shares on the TSX Venture Exchange is C$0.48 or more per common share during a ten consecutive trading day period. The warrants will terminate on the 30th day after the Company has issued a notice of accelerated expiry to the warrant holders. After this, the warrant holders shall have no right to acquire any common shares of the Company under the warrant. Mike Stark expressed delight that the institutional fund held onto 9.9% of their purchase, evidently sharing the same perspective as management regarding the Philadelphia property. The organization intends to further utilize the funds raised from the private placement to explore the Philadelphia Property in Mohave County, Arizona, to progress their other projects and for general working capital.

Within the private placement, insiders of the Company obtained command and management of over 80,000 units. This placement to such parties is classified as a “related party transaction” per TSX Venture Exchange Policy 5.9 and MI 61-101. The Company has taken advantage of the exemptions from the formal appraisal and minority shareholder ratification prerequisites of MI 61-101 in sections 5.5(a) and 5.7(1)(a). This was because the fair market value of the subject matter, or the consideration of the transaction involving the related parties, was less than 25% of the Company’s market capitalization as per MI 61-101.

The private placement is subject to various conditions, including obtaining all the necessary approvals, with the final one being from the TSX Venture Exchange. Additionally, all securities issued through the private placement must abide by the four-month holding period mandated by Canadian securities laws.